Fast, Frictionless and Automated

Embedded Payment Solutions for Banks

and Businesses

- Innovative – our blockchain ledger technology is centralized,

enabling you to scale quickly while reducing costs. - Faster – accelerate your time to market with nanopay APIs for

tight integration or branded white-label applications. - Easier – with over 400 microservices, nanopay provides

interchangeable building blocks making it easy to build on

legacy infrastructure.

Fast, Frictionless and Automated

Embedded Payment Solutions for Banks

and Businesses

- Innovative – our blockchain ledger technology is centralized, enabling you to scale quickly while reducing costs.

- Faster – accelerate your time to market with nanopay APIs for tight integration or branded white-label applications.

- Easier – with over 400 microservices, nanopay provides interchangeable building blocks making it easy to build on legacy infrastructure.

Reimagine the future of payments with us, at nanopay.

Fast, Frictionless and Automated

Embedded Payment Solutions for Banks

and Businesses

- Innovative – our blockchain ledger technology is centralized, enabling you to scale quickly while reducing costs.

- Faster – accelerate your time to market with nanopay APIs for tight integration or branded white-label applications.

- Easier – with over 400 microservices, nanopay provides interchangeable building blocks making it easy to build on legacy infrastructure.

Reimagine the future of payments with us, at nanopay.

With a strong focus on risk and compliance, we partner with tier 1 banks

that help us deliver domestic and international payments. We go to

market through distribution partners like Intuit for QuickBooks AR

payments and NBP for remittance.

Our Partners

With a strong focus on risk and compliance, we partner with tier 1 banks that help us deliver domestic and international payments. We go to market through distribution partners like Intuit for QuickBooks AR payments and NBP for remittance.

Our Partners

With a strong focus on risk and compliance, we partner with tier 1 banks that help us deliver domestic and international payments. We go to market through distribution partners like Intuit for QuickBooks AR payments and NBP for remittance.

For Everyday Payment Problems

and easy configuration to create a number of different payment solutions.

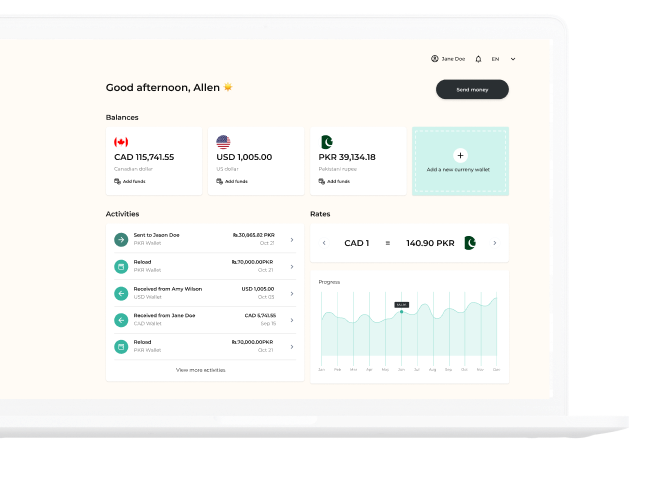

solutions with send and request money

capabilities featuring data rich and traceable

ecommerce and mobile payments.

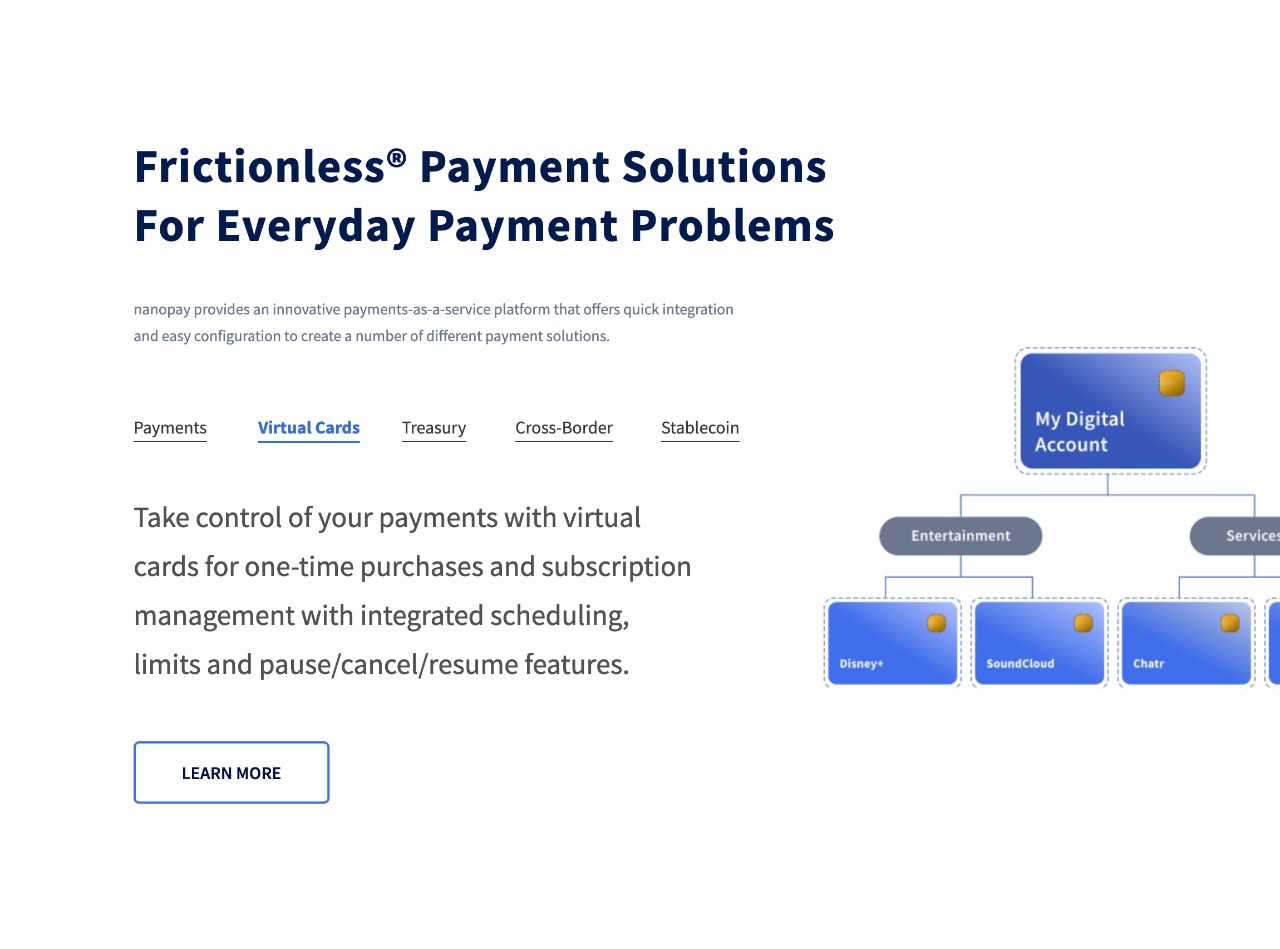

For Everyday Payment Problems

and easy configuration to create a number of different payment solutions.

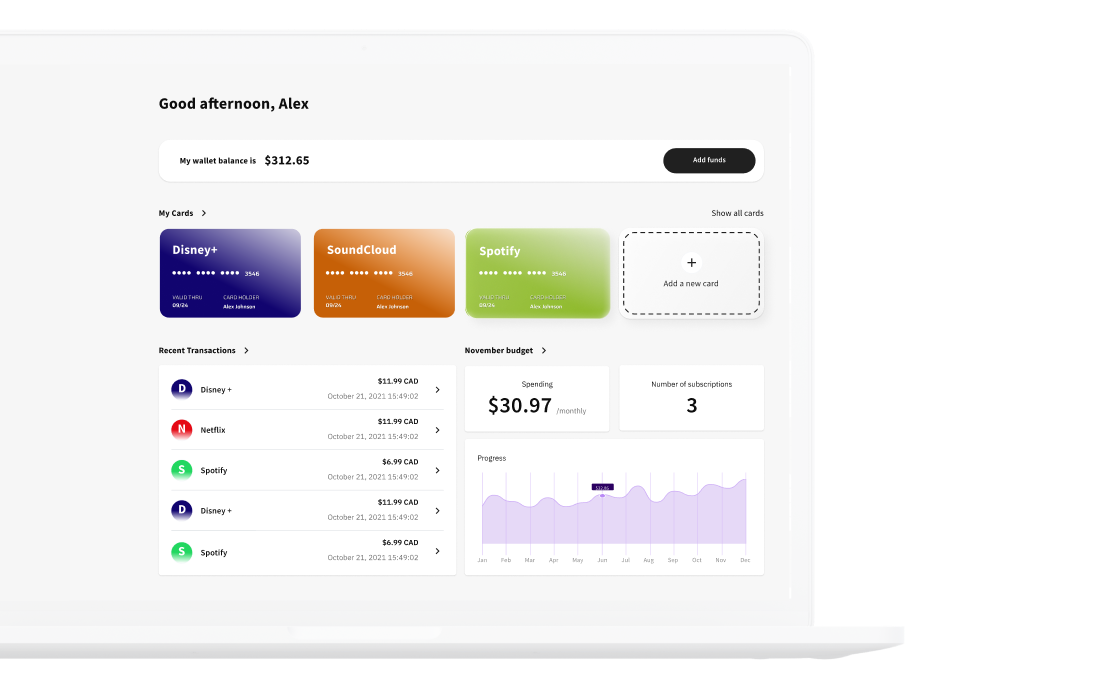

cards for one-time purchases and subscription

management with integrated scheduling,

limits and pause/cancel/resume features.

For Everyday Payment Problems

and easy configuration to create a number of different payment solutions.

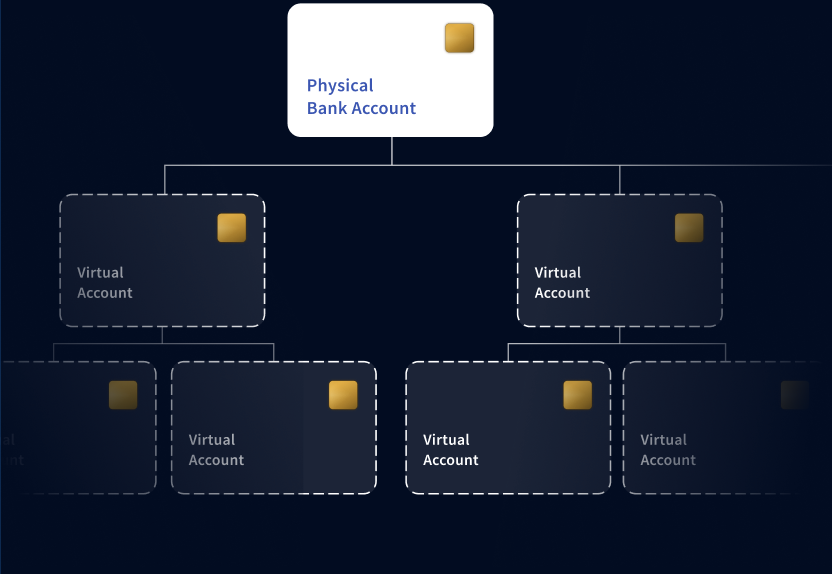

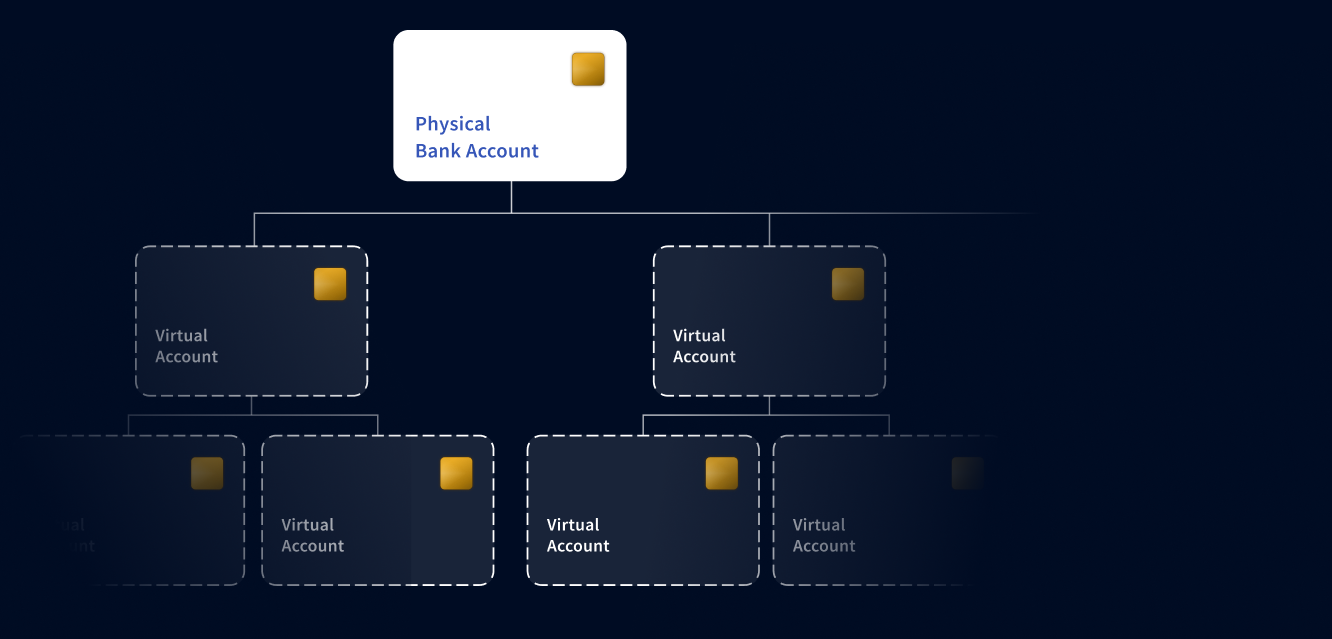

solutions built on a virtual account

ecosystem to net, pool funds, and better

manage payables and receivables.

For Everyday Payment Problems

and easy configuration to create a number of different payment solutions.

including remittance, payroll and bill

payments with competitive FX rates and

configurable fee options.

For Everyday Payment Problems

and easy configuration to create a number of different payment solutions.

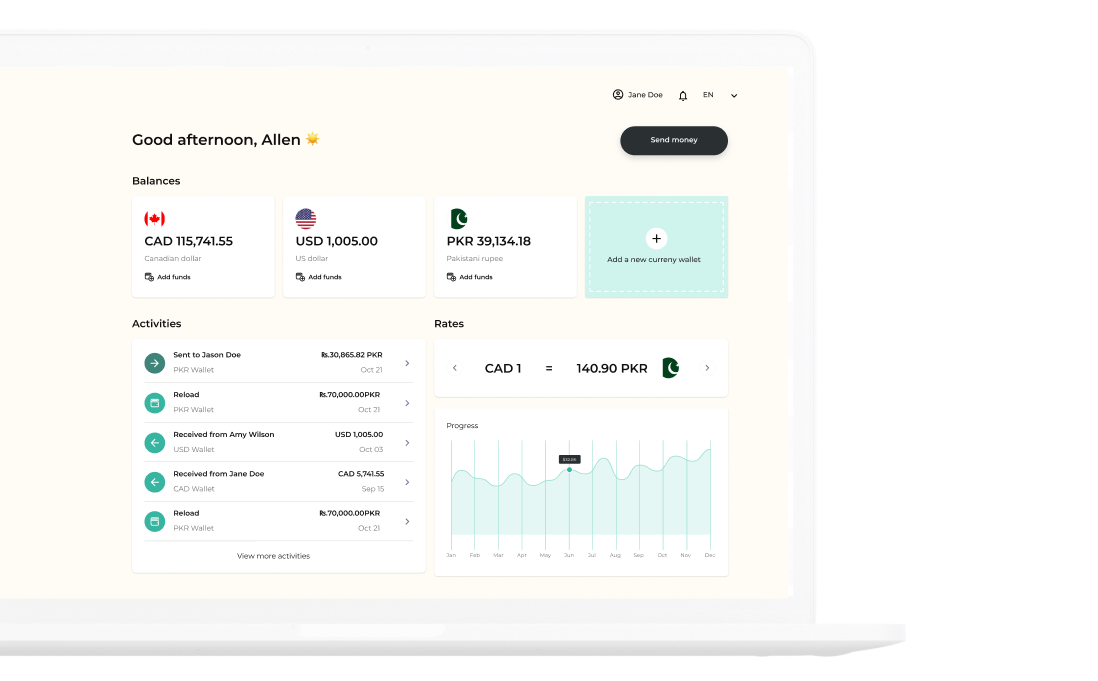

with value centrally stored in digital wallets

that power applications to send, request

and receive digital payments instantly.

For Everyday Payment Problems

platform that offers quick integration and easy configuration

to create a number of different payment solutions.

solutions with send and request money

capabilities featuring data rich and traceable

ecommerce and mobile payments.

For Everyday Payment Problems

platform that offers quick integration and easy configuration

to create a number of different payment solutions.

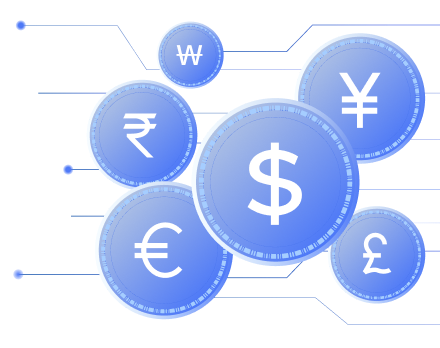

for one-time purchases and subscription

management with integrated scheduling, limits

and pause/cancel/resume features.

For Everyday Payment Problems

platform that offers quick integration and easy configuration

to create a number of different payment solutions.

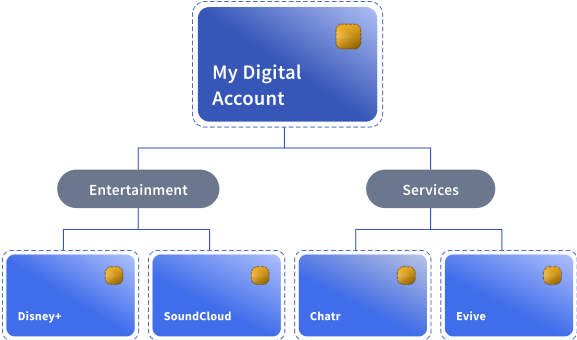

solutions built on a virtual account

ecosystem to net, pool funds, and better

manage payables and receivables.

For Everyday Payment Problems

platform that offers quick integration and easy configuration

to create a number of different payment solutions.

including remittance, payroll and bill

payments with competitive FX rates and

configurable fee options.

For Everyday Payment Problems

platform that offers quick integration and easy configuration

to create a number of different payment solutions.

with value centrally stored in digital wallets

that power applications to send, request and

receive digital payments instantly.

Our Innovative Payment

Solutions Help You Scale

professionals, cryptographers and software engineers, we will strive to

make your vision a reality with our embedded payment solutions.

Our Innovative Payment

Solutions Help You Scale

professionals, cryptographers and software engineers, we will strive to

make your vision a reality with our embedded payment solutions.

Our Innovative Payment

Solutions Help You Scale

Backed by a team of payment industry experts, certified treasury professionals, cryptographers and software engineers, we will strive to make your vision a reality with our embedded payment solutions.

Our Technology

nanopay’s technology was built to central bank compliance standards to deliver CBDC to central banks.

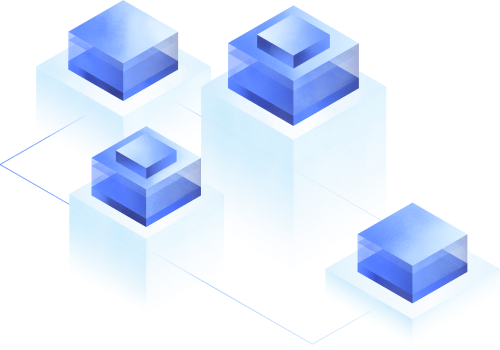

Reimagining The Blockchain

With our next-generation centralized blockchain ledger, nanopay provides centralized authority and control that enables the highest levels of performance, resilience, and scalability. With built-in cryptographic security, nanopay digitizes money to move value from one user to another.

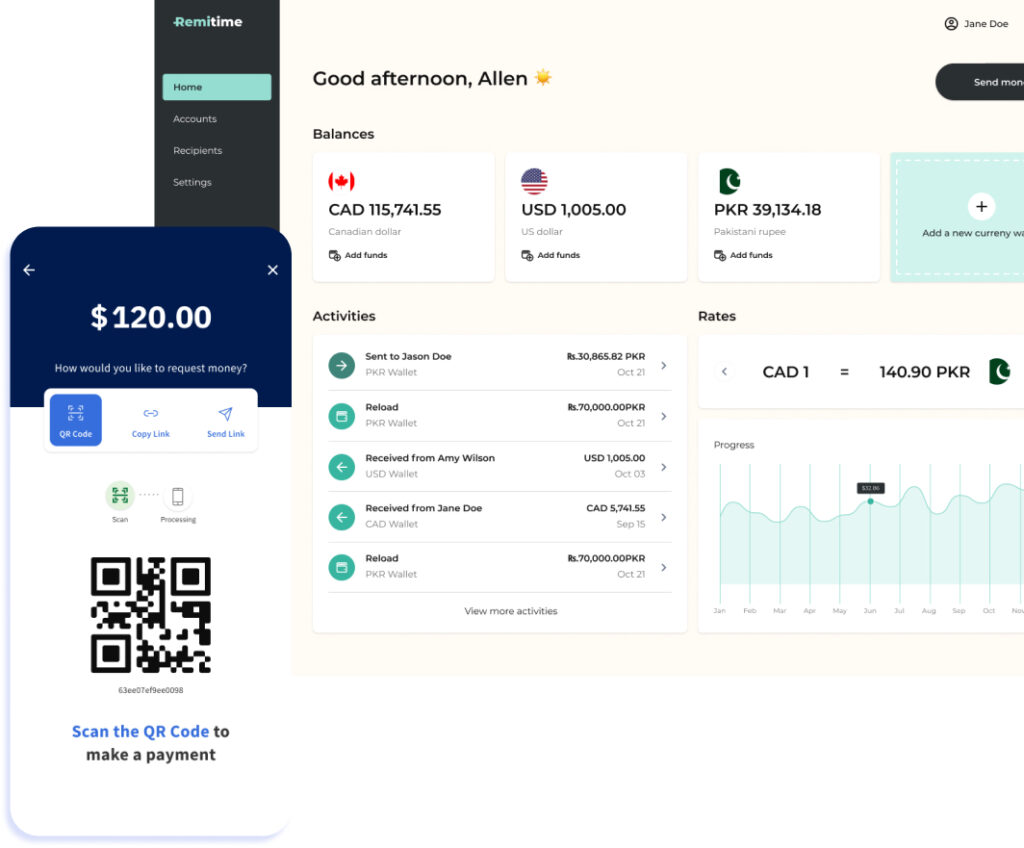

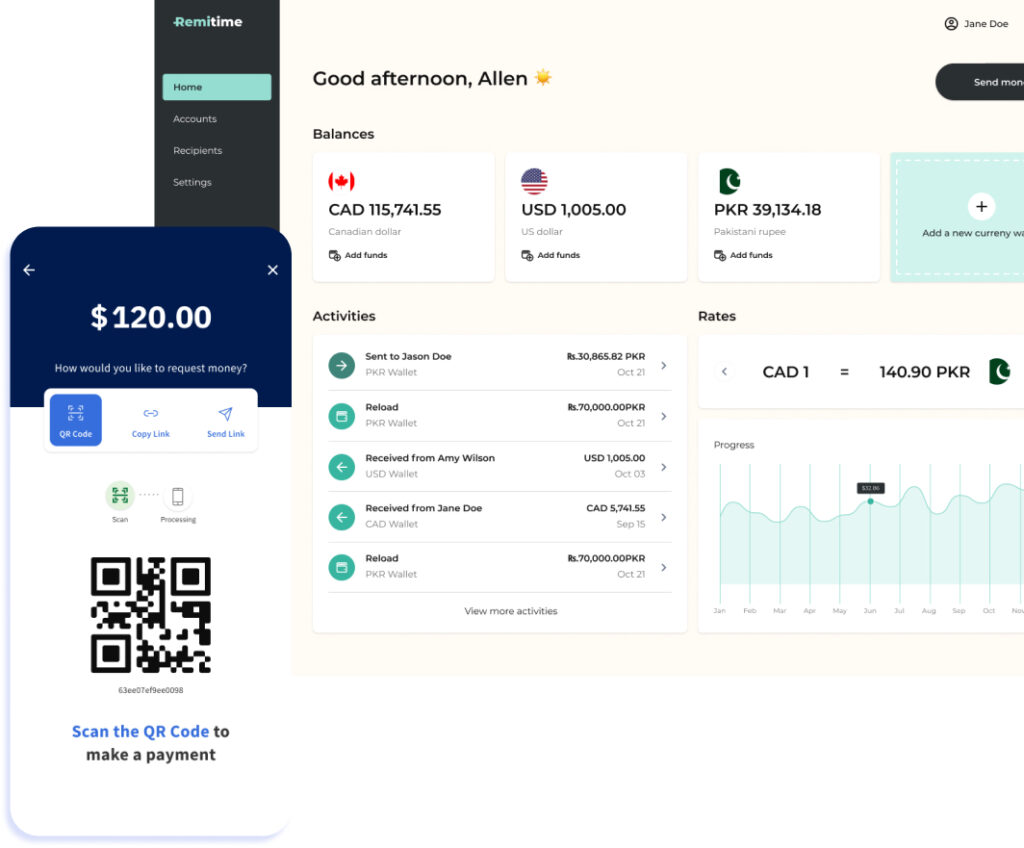

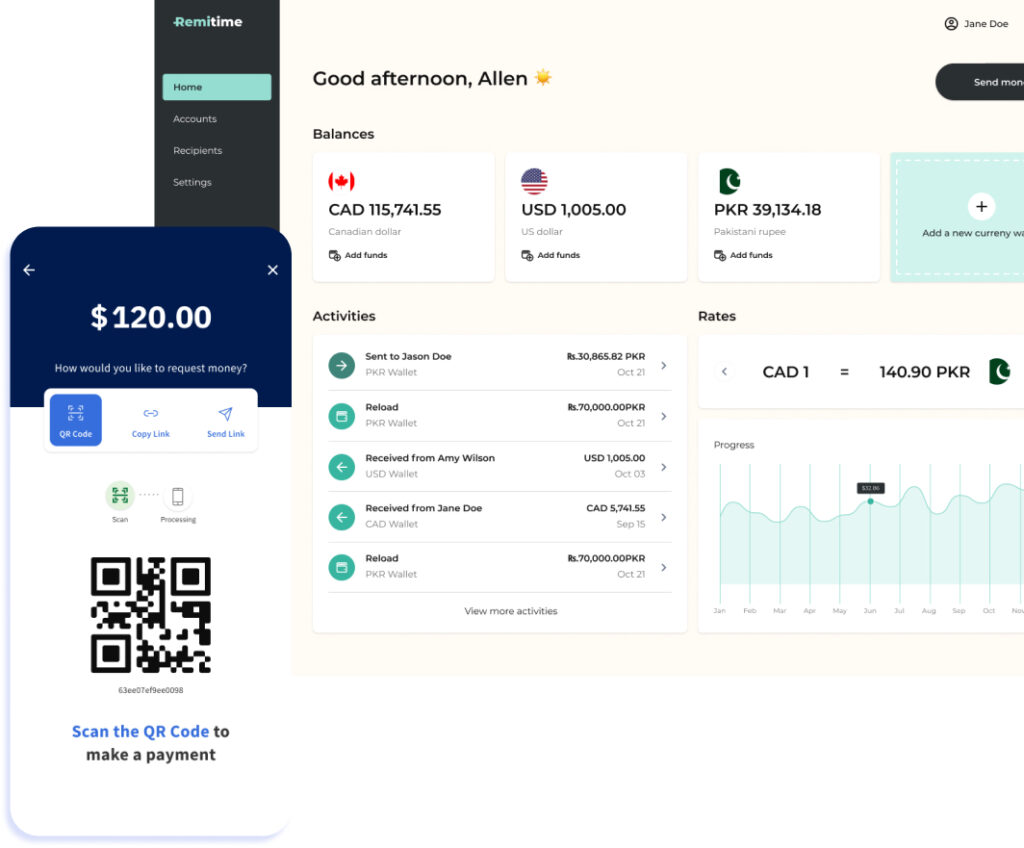

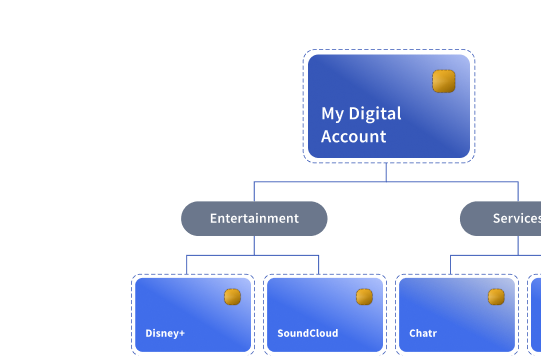

Designed for White Label

nanopay enables banks, fintechs, and businesses to white-label and payment enable new applications for clients. You focus on the branding and user experience rather than spending time and resources to build the technology from the ground up. nanopay gets you to market in days or weeks.

Designed For Developers

nanopay features secure API access that reduces integration time and project risk. The easy-to-use technology can be quickly deployed on-premise or in the cloud and was built from the ground up to support ISO 20022 messaging standards.

Our Technology

nanopay’s technology was built to central bank compliance standards to deliver CBDC to central banks.

Reimagining The Blockchain

With our next-generation centralized blockchain ledger, nanopay provides centralized authority and control that enables the highest levels of performance, resilience, and scalability. With built-in cryptographic security, nanopay digitizes money to move value from one user to another.

Designed for White Label

nanopay enables banks, fintechs, and businesses to white-label and payment enable new applications for clients. You focus on the branding and user experience rather than spending time and resources to build the technology from the ground up. nanopay gets you to market in days or weeks.

Designed For Developers

nanopay features secure API access that reduces integration time and project risk. The easy-to-use technology can be quickly deployed on-premise or in the cloud and was built from the ground up to support ISO 20022 messaging standards.

Our Technology

nanopay’s technology was built to central bank compliance standards to deliver CBDC to central banks.

Reimagining The Blockchain

With our next-generation centralized blockchain ledger, nanopay provides centralized authority and control that enables the highest levels of performance, resilience, and scalability. With built-in cryptographic security, nanopay digitizes money to move value from one user to another.

Designed for White Label

nanopay enables banks, fintechs, and businesses to white-label and payment enable new applications for clients. You focus on the branding and user experience rather than spending time and resources to build the technology from the ground up. nanopay gets you to market in days or weeks.

Designed For Developers

nanopay features secure API access that reduces integration time and project risk. The easy-to-use technology can be quickly deployed on-premise or in the cloud and was built from the ground up to support ISO 20022 messaging standards.

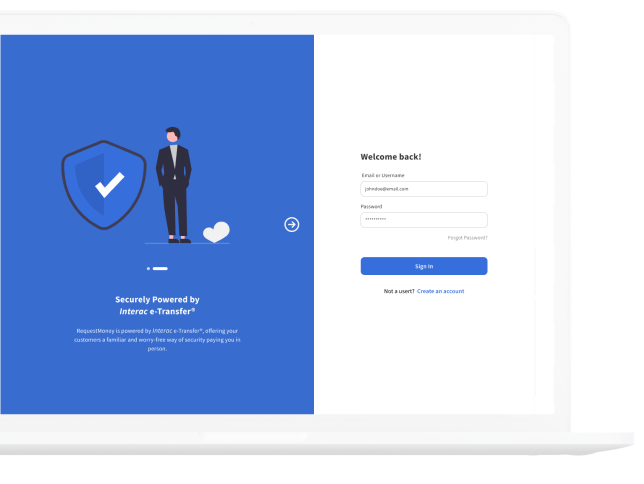

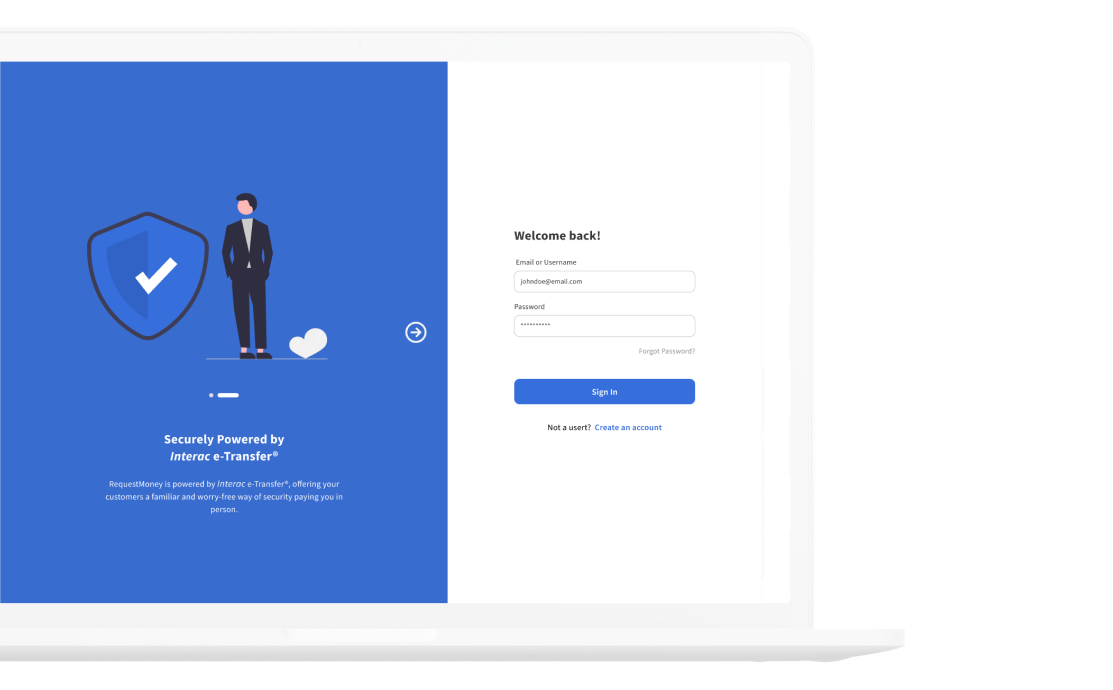

Way to Get Paid

directly from their bank. Powered by Interac e-Transfer®,

Requestmoney provides your customers with a familiar

and worry-free way to pay you in-person or email.

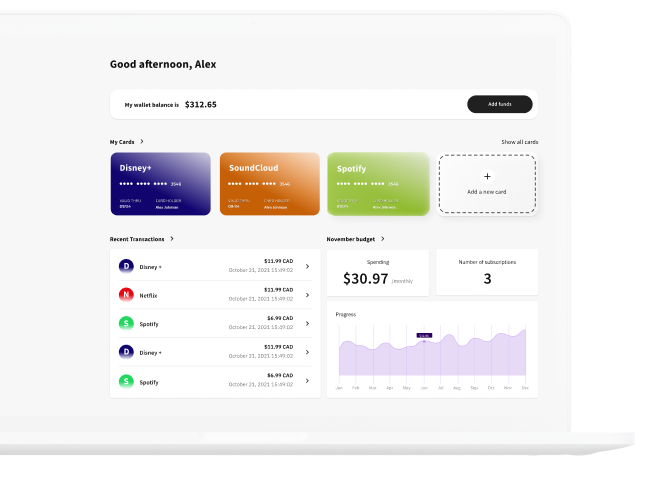

Rule Them All

subscriptions directly from the Cardmeleon app. Set up

custom schedules, and spend limits; pause, resume, or

cancel cards any time you want.

Border Free

customers to send cross-border payments whether they

are individuals or businesses.

Made Easy

Management solution that provides complete visibility,

simplifies payment reconciliation and improves financial

reporting - without the fees and complexities of

maintaining many physical bank accounts.

pay you directly from their bank. Powered by

Interac e-Transfer®, Requestmoney provides

your customers with a familiar and worry-free

way to pay you in-person or online.

Way to Get Paid

or recurring subscriptions directly from the

Cardmeleon app. Set up custom schedules,

and spend limits; pause, resume, or cancel

cards any time you want.

Rule Them All

to enable your customers to send cross-border

payments whether they are individuals or

businesses.

Border Free

Account Management solution that provides

complete visibility, simplifies payment

reconciliation and improves financial reporting -

without the fees and complexities of maintaining

many physical bank accounts.

Made Easy

It’s Time To Better Your Business

take their payment systems. From our individual products such as Request Money and Cardmeleon,

to our white-label options, our solutions are designed to take your payments to the next level.

It’s Time To Better Your Business

take their payment systems. From our individual products such as Request Money and Cardmeleon,

to our white-label options, our solutions are designed to take your payments to the next level.